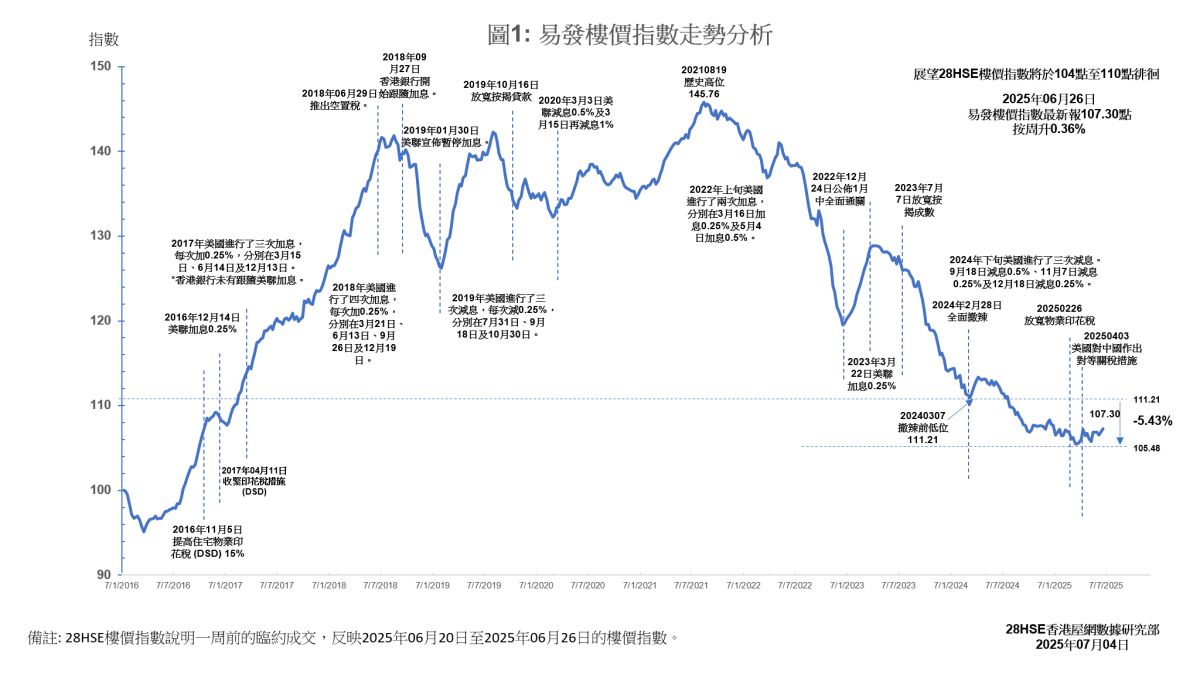

The Eva Property Index has risen for two consecutive weeks, reflecting a more active second-hand market due to falling HIBOR rates and the phenomenon of “mortgage payments being cheaper than rent.” However, prices overall remain low, with the uptrend limited by high primary housing inventory and economic uncertainty. Regional performance diverges: the New Territories saw a slight increase, while urban areas experienced a decline.

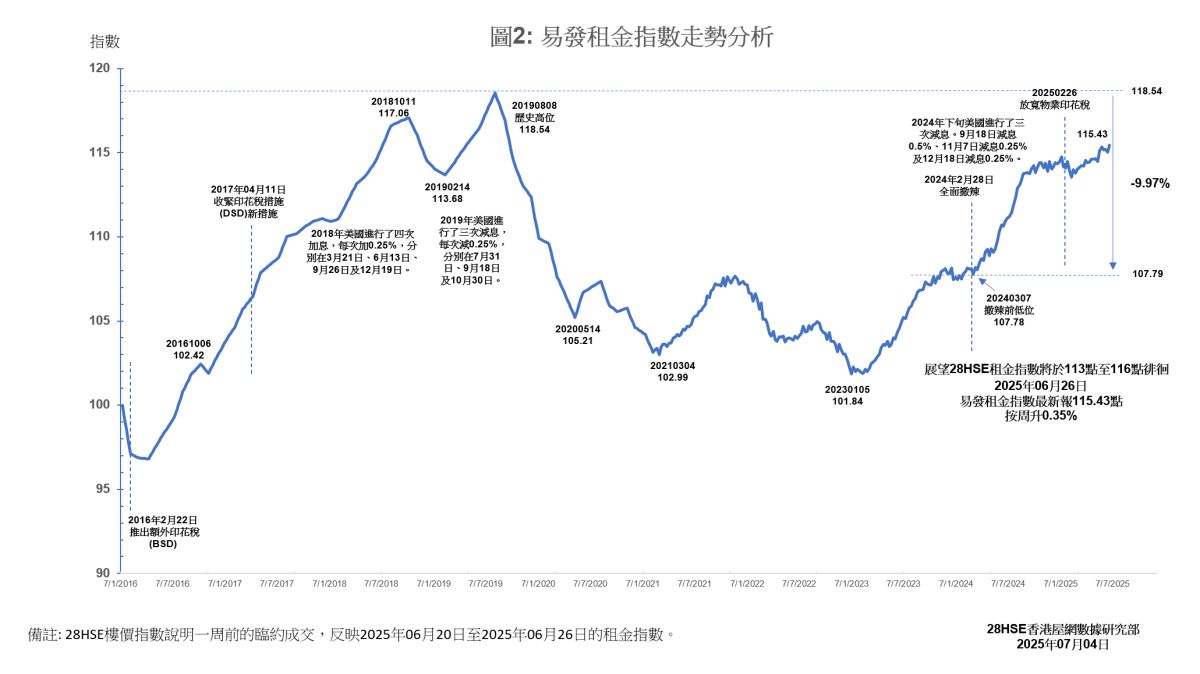

Rental Market Momentum

In the leasing market, driven by the summer peak season and demand from mainland students, the rental index hit a year-high with gains across all four major districts. Rents are expected to continue rising in the short term.

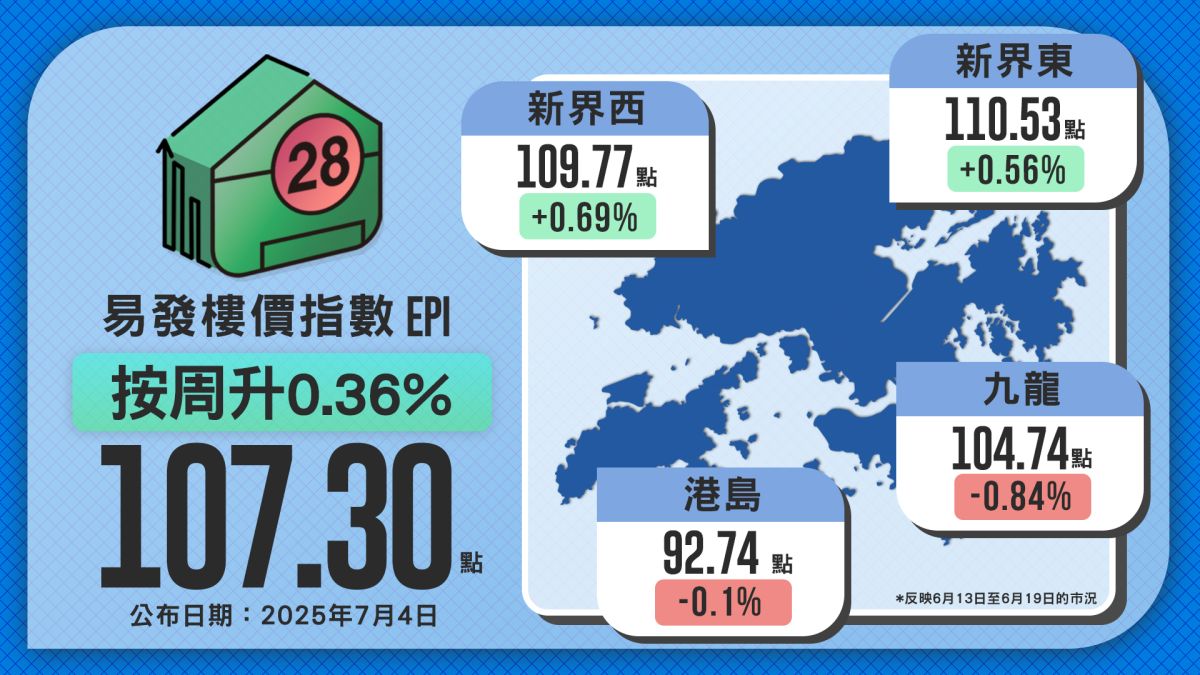

Eva Property Index Latest at 107.30 — Still at 8.5-Year Low Despite Weekly Gain

Hong Kong property prices have recently shown volatile trends. The latest Eva Property Index stood at 107.30 (reflecting the market from June 20 to June 26, 2025), up slightly by 0.36% week-on-week. While close to the peak in January this year, the index remains at an 8.5-year low, down 0.38% year-to-date, although the decline has narrowed.

With interbank interest rates falling, more buyers are enticed by the fact that mortgage payments are now lower than rents. The lack of major new launches over the weekend — with only remaining units at developments like “PARK YOHO” in Tai Wai and “Miami Quay II” in Kai Tak on offer — has driven purchasing power back to the second-hand market.

According to agency data, 63 transactions were recorded across the 20 major estates that week, up over 40% week-on-week — a 34-week high. This reflects improved market sentiment due to the low-interest environment and stronger buying intention among prospective homebuyers.

However, with the U.S.-China tariff policy still uncertain and global tax rate directions possibly only becoming clearer after the 90-day grace period (post-July 9), combined with an estimated over 20,000 unsold completed units in the primary market, price growth may remain under pressure. The Q3 index is expected to hover around 106, suggesting a soft near-term price trend amid a wait-and-see sentiment.

Divergent Regional Price Trends — Kowloon Ends 3-Week Uptrend

Regional price indices show a mixed pattern, indicating diverging market trends across districts. The New Territories performed relatively steadily:

New Territories East: 110.53 (+0.56% WoW), hovering around 110

New Territories West: 109.77 (+0.69% WoW), maintaining above 109 for four straight weeks

The gains were mainly supported by lower interbank rates and the government’s HKD 100 stamp duty concession for properties below HKD 4 million, which boosted small- to mid-size flat transactions.

In contrast, urban prices remain under pressure:

Kowloon: 104.74 (-0.84% WoW), ending a 3-week uptrend

Hong Kong Island: 92.74 (-0.1% WoW)

For example, new flats at “The Holborn” in Sai Ying Pun saw steep price cuts of around 30% — from HKD 30,229/sqft (net effective price in March 2021) to around HKD 19,924/sqft — significantly diverting demand away from the second-hand market, leading to subdued resale activity.

Overall, regional performances show increasing divergence in trends.

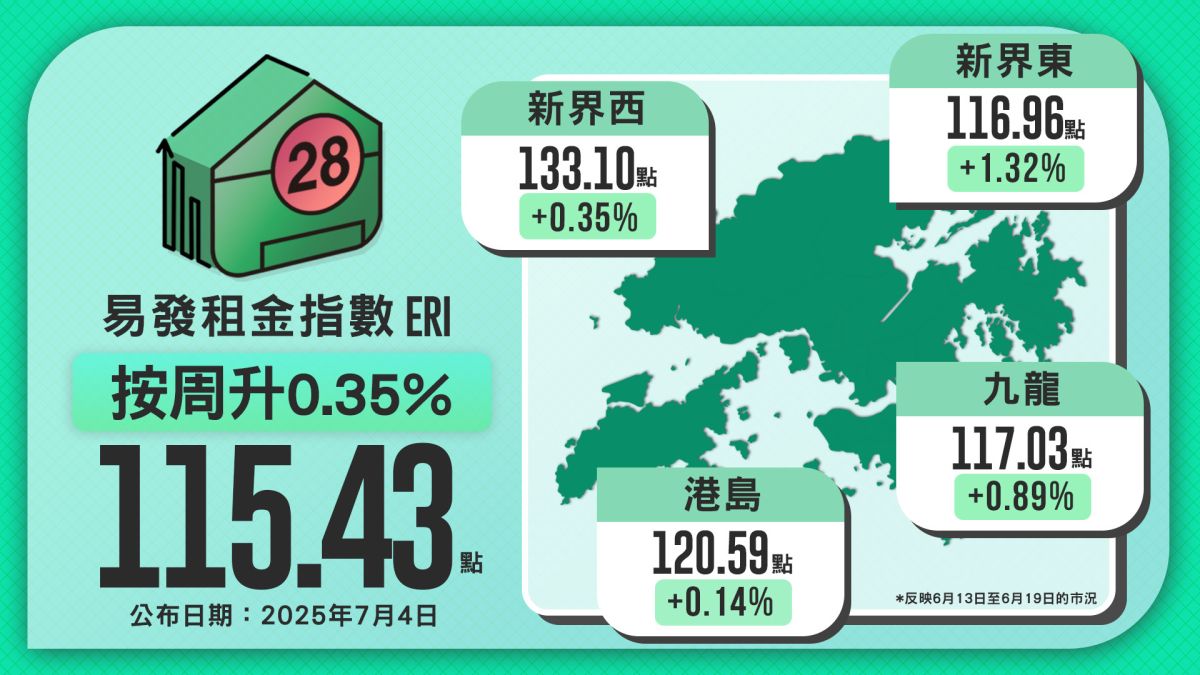

Eva Rental Index Hits 2025 High at 115.43 — All Four Regions See Increases

As the summer leasing peak begins, mainland students have become a major driver of demand, accelerating rental activity. The latest Eva Rental Index rose to 115.43 (+0.35% WoW), staying above 115 for six weeks and hitting a new high for the year — signaling a strong rental market sentiment.

Regional breakdown:

New Territories East: 116.96 (+1.32% WoW), up for 2 weeks in a row

Kowloon: 117.03 (+0.89% WoW)

New Territories West: 133.1 (+0.35% WoW)

Hong Kong Island: 120.59 (+0.14% WoW)

Agents expect rental prices to continue climbing this year, mainly due to global economic uncertainty and the U.S. Federal Reserve holding rates steady at its June meeting (contrary to expectations of a cut). This has caused many buyers to delay purchases and instead turn to the rental market, further pushing up demand and rental levels.

This week's index reflects market conditions from June 20 to June 26, 2025.

Like