- Home

- News

- Property Index

- Eva Property Price Index Moves Sideways Amid Narrow Range; Falling Hibor Hits Two-year Low, Potential Boost For Secondary Market

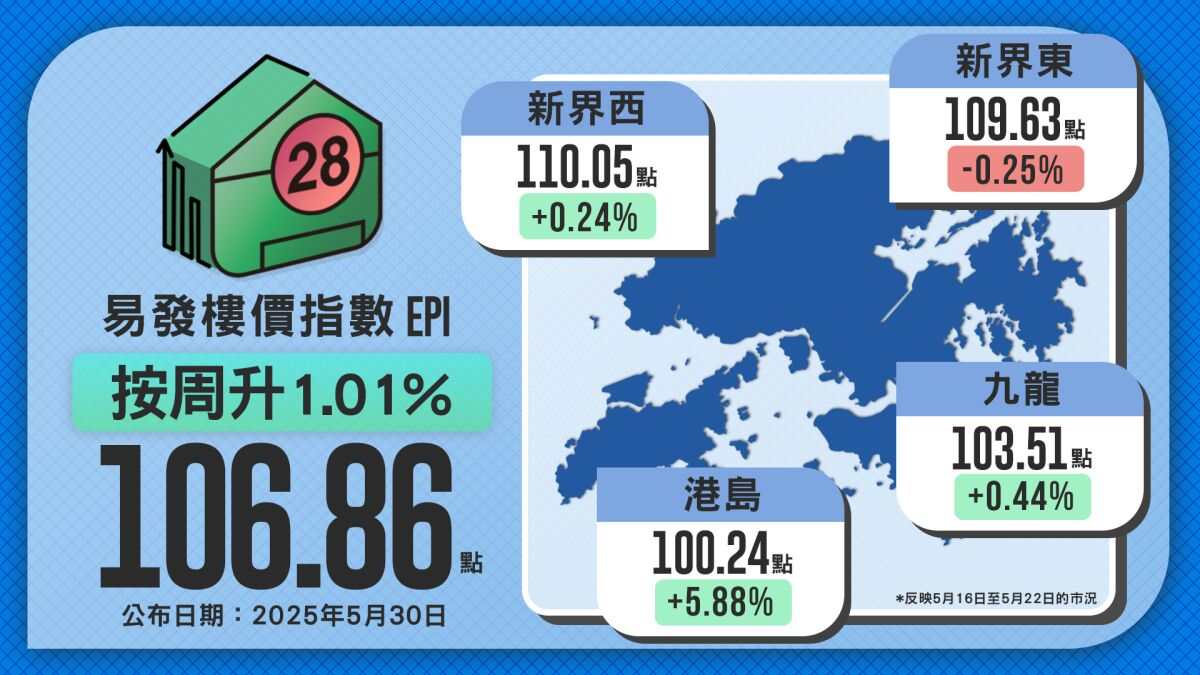

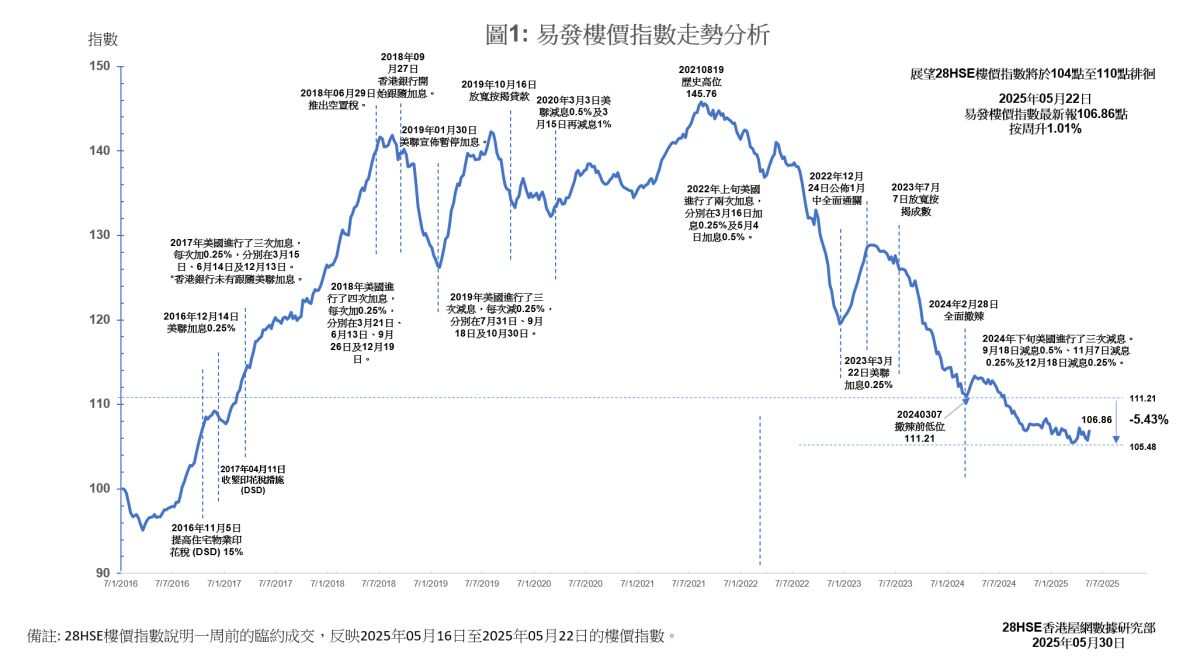

The Eva Property Price Index currently stands at 106.86 points, marking the fourth consecutive week it has hovered narrowly around the 106 level. This remains at a low not seen in the past eight years, suggesting the overall property market is still in a bottoming-out phase. The index reflects market conditions from May 16 to May 22, 2025. During this period, the banking system remained flush with liquidity, leading to a continued drop in funding costs. The 1-month Hong Kong Interbank Offered Rate (HIBOR) declined steadily, falling to just 0.66% as of May 22, a new low in over two years.

Under the current mainstream HIBOR-linked mortgage plans (H-Plan), the effective mortgage interest rate stands at about HIBOR + 1.3%, or approximately 1.96%. This is significantly lower than the usual cap rate of 3.5%, easing the financial burden for potential homebuyers and helping to unlock latent purchasing power.

Improved Market Sentiment Reflected in Secondary Transactions

The slightly improved market sentiment is evident in secondary market activity. According to estate agency statistics, weekly transaction volumes in the top 50 housing estates have held firm at around 90 cases for three consecutive weeks. Last week recorded 93 transactions, a 3% weekly increase. Meanwhile, 1,090 viewing appointments were recorded across the same 50 estates over the weekend, up 6.9% from the previous week—marking two straight weeks of gains. This suggests that potential buyers are gradually accelerating their market entry.

Diverging Regional Trends, With Hong Kong Island Outperforming

In terms of regional price trends, a pattern of "three gains, one decline" has emerged recently. Hong Kong Island showed the most significant gain, with the index climbing to 100.24 points, up 5.88% week-on-week, marking a two-week rise. This growth is believed to be linked to the concurrent launch of the “La Montagne” project at Wong Chuk Hang Station in South Island, which spurred market activity in the surrounding area.

Kowloon and New Territories West recorded mild gains, at 103.51 and 110.05 points respectively, up 0.44% and 0.24% week-on-week, indicating overall stability. However, New Territories East saw a slight dip of 0.25%, closing at 109.63 points. Although modest, the decline is likely due to the full sell-out of all 376 units in the “Sierra Sea” project in Sai Sha over the weekend, which absorbed a large share of market demand and temporarily suppressed transactions in surrounding estates.

Eva Price Index Still Range-Bound Amid Developer Discounts

Despite some signs of price stabilization, developers are ramping up their pace of new project launches, adopting aggressive pricing strategies to capture market share—exerting downward pressure on property prices. For example, projects like "UNI Residence" in Hin Keng, "Sierra Sea" in Sai Sha, and remaining units at "Grand Seasons" in LOHAS Park are all being sold quickly through attractive pricing. This has diverted some of the demand from the secondary market.

Given the intense competition between primary and secondary markets—and buyers remaining cautious despite low interest rates—the Eva Property Price Index is expected to continue fluctuating between 104 and 108 points into the second half of the year, with a bottom consolidation pattern unlikely to break in the near term.

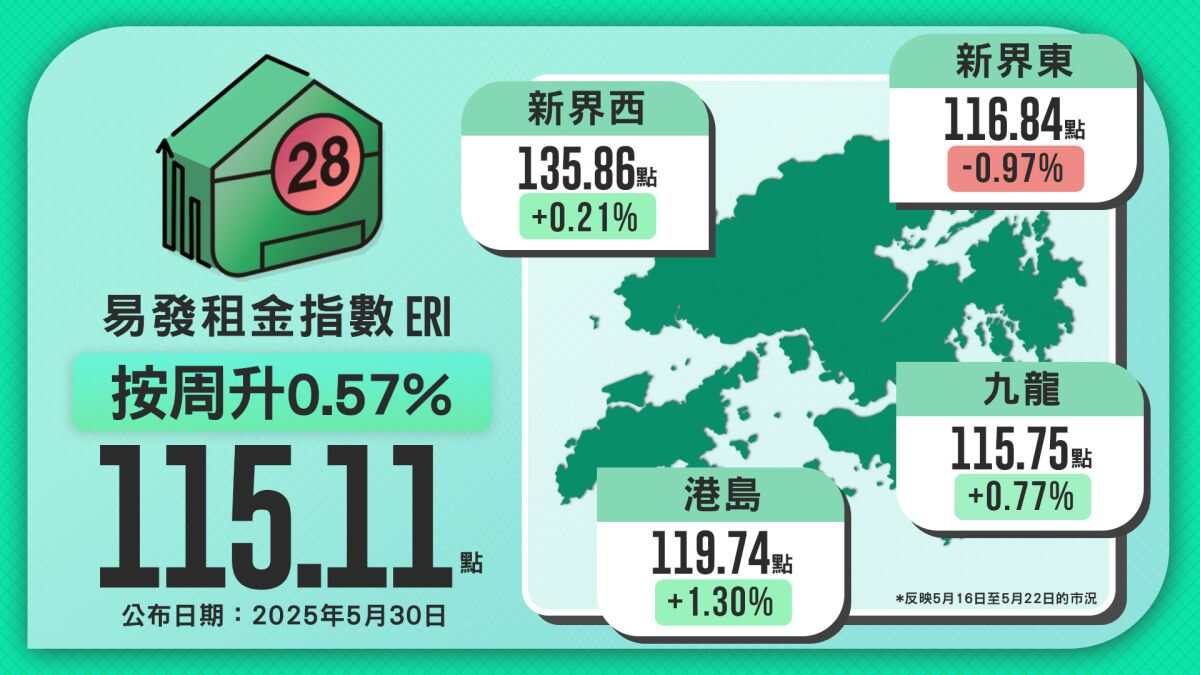

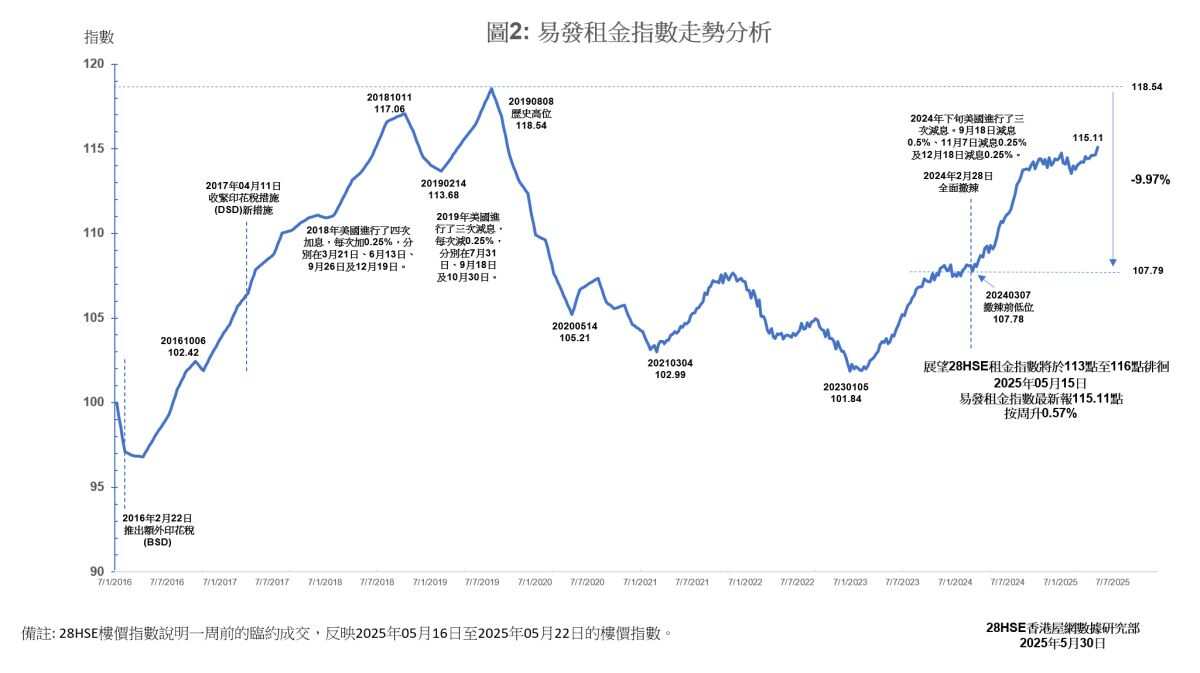

Eva Rental Index Hits New Year-To-Date High at 115.11 Points

The Eva Rental Index rose slightly by 0.57% this week to 115.11 points, setting a new high for 2025 so far. This reflects the ongoing strength in the local rental market. As HIBOR continues to fall and mortgage rates stay low, cases where mortgage payments are lower than rents are becoming more common. Nevertheless, uncertainties in the global economy, such as the U.S.-China tariff war, and unclear local employment and inflation prospects, are prompting many potential buyers to remain on the sidelines and instead opt to rent—further fueling rental demand.

Regionally, the rental market also showed a "three gains, one decline" pattern. Hong Kong Island posted the largest rise, reaching 119.74 points, up 1.3% week-on-week. Kowloon and New Territories West followed at 115.75 and 135.86 points, rising 0.77% and 0.21% respectively. With limited new supply in the short term, steady demand, and continued market cautiousness, the rental index is expected to continue climbing, particularly as the peak rental season approaches—possibly setting new highs for the year.

This week's index reflects market conditions from May 16 to May 22, 2025.

Like