- Home

- News

- Property Index

- Primary Market Absorbing Significant Buying Power, Eva Property Index Stays Flat Around 106 Points

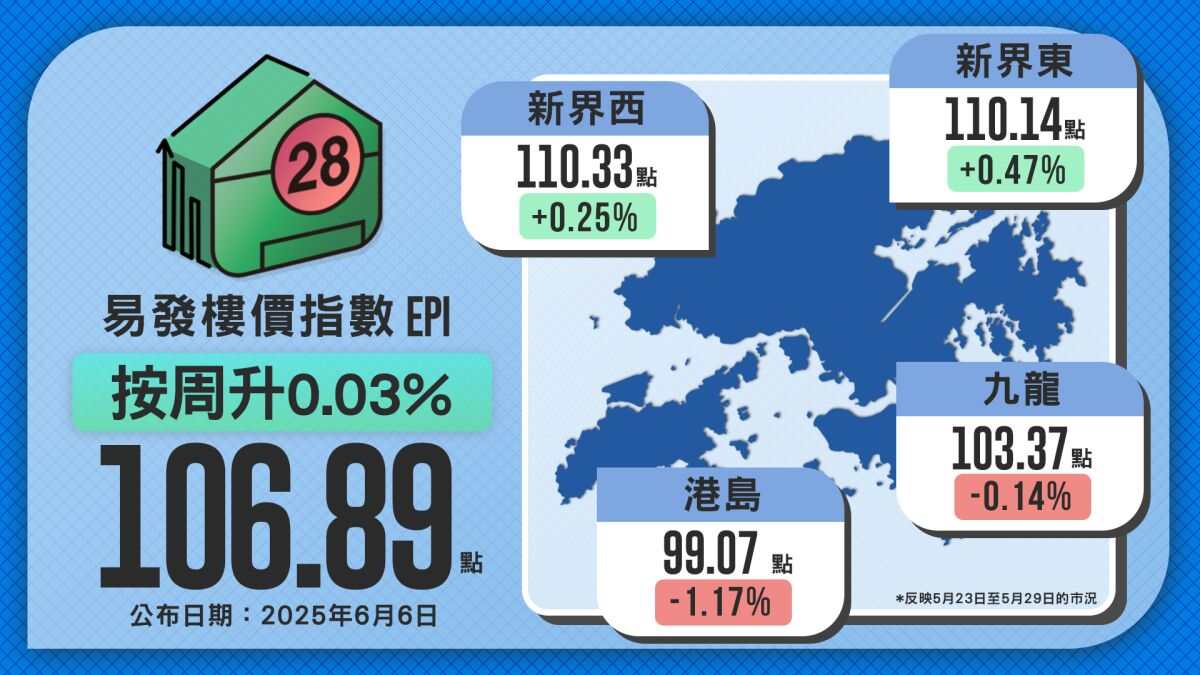

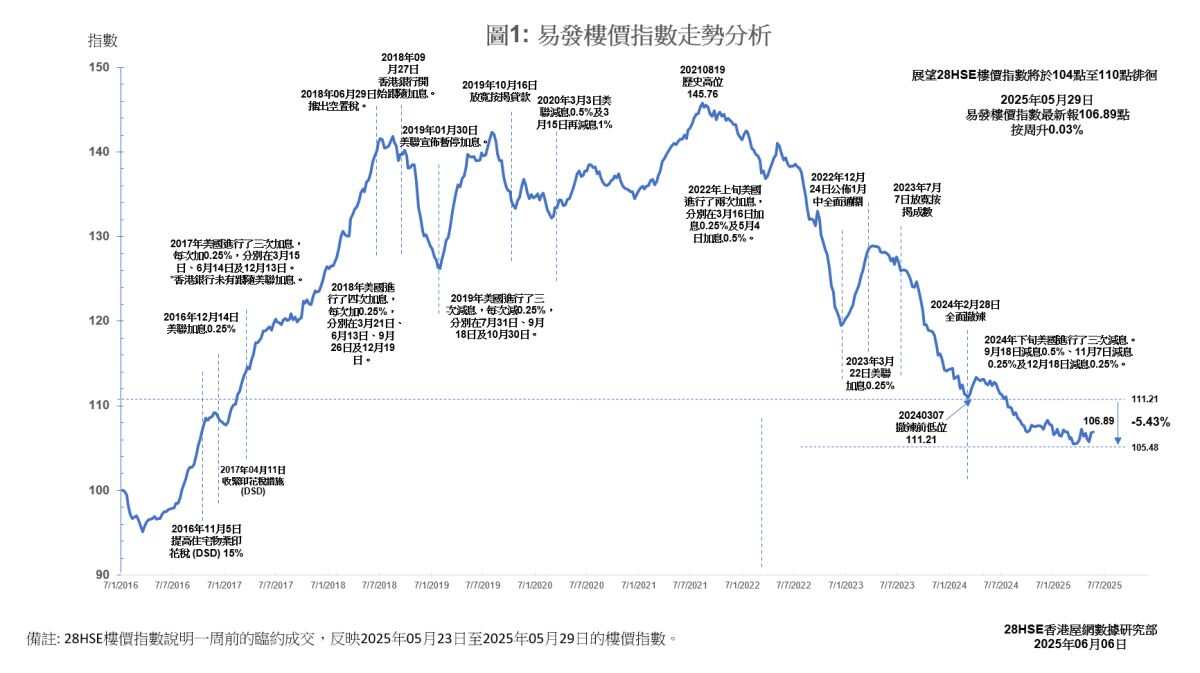

The latest Eva Property Index stands at 106.89 points, reflecting the market conditions from May 23 to May 29, 2025. It rose marginally by 0.03% from the previous week, yet the overall trend remains uncertain. The index has hovered around the 106 level for six consecutive weeks, indicating a stagnant market. It also remains at its lowest level in eight and a half years, with a year-to-date drop of 0.83% in property prices.

Despite the weak overall property market, the primary market is showing relative vibrancy, with buying power clearly concentrated there. For instance, the “Sierra Sea” project in Sai Sha sold all 241 units over the past weekend, with over 1,500 units sold in total, marking strong performance. Similarly, “The Henley” in East Kowloon achieved near-total sell-out after reducing prices by up to 17.5% for around 80 units, pushing weekend primary sales above 300 transactions.

In contrast, the secondary market remains sluggish. According to agency statistics, transaction volumes for the top ten housing estates have all dropped to single digits, reflecting persistently weak buyer confidence. Although the impact of high interest rates on the market is slowly easing, high inventory levels and buyer preference for new projects continue to pressure second-hand prices. In the short term, the CCL is expected to remain under pressure, likely fluctuating narrowly between 104 and 108 points, with the market’s consolidation at a low level difficult to break in the near future.

Regional Index Shows “Two Up, Two Down” — Hong Kong Island Posts Largest Decline

Regarding regional property indices, the latest data reflects a “two up, two down” pattern:

Hong Kong Island: Fell to 99.07 points, down 1.17% week-on-week, erasing gains from the past two weeks. This suggests that high-end areas are still under pressure.

Kowloon: Slight drop to 103.37 points, down 0.14%, marking the third week of narrow fluctuation around 103 points, indicating price stagnation.

New Territories East and West: Showed slight gains. New Territories East rose to 110.14 points (+0.47%) and New Territories West to 110.33 points (+0.25%). These gains are believed to be driven by the hot sales of the “Sierra Sea” project in Sai Sha, which helped boost market sentiment. Additionally, the relatively lower property prices in the New Territories compared to Hong Kong Island and Kowloon have attracted budget-conscious buyers to the secondary market, contributing to the slight rise in the regional indices.

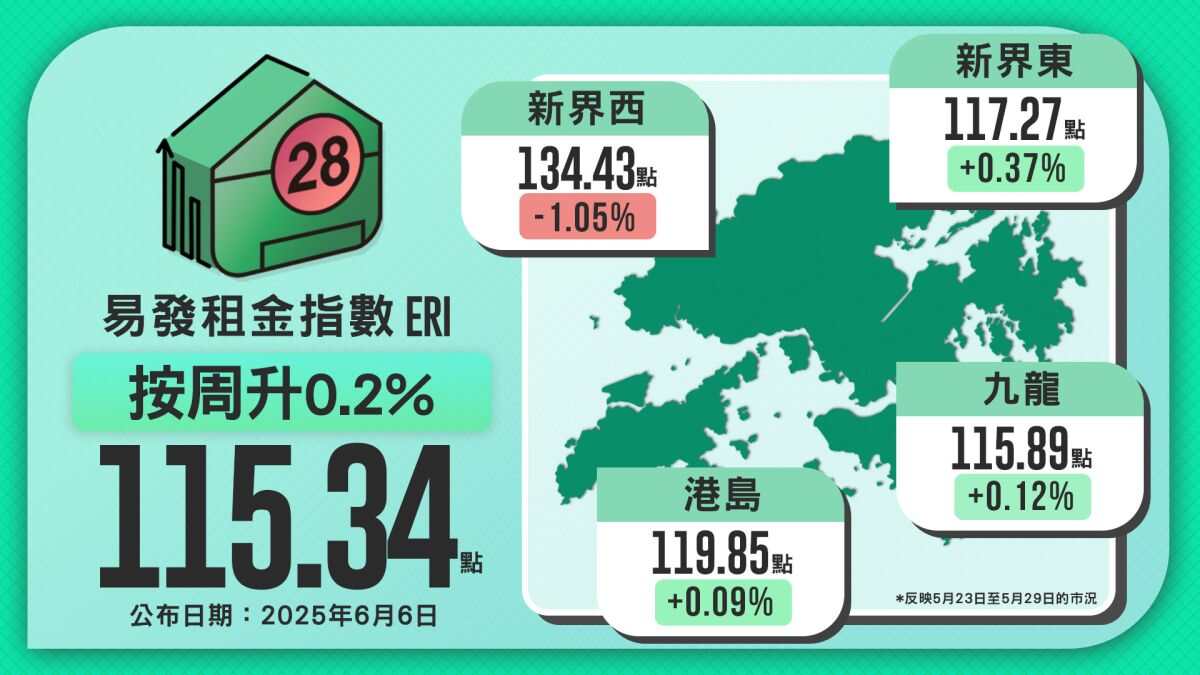

Eva Rental Index Continues Climb, Now at 115.34 Points

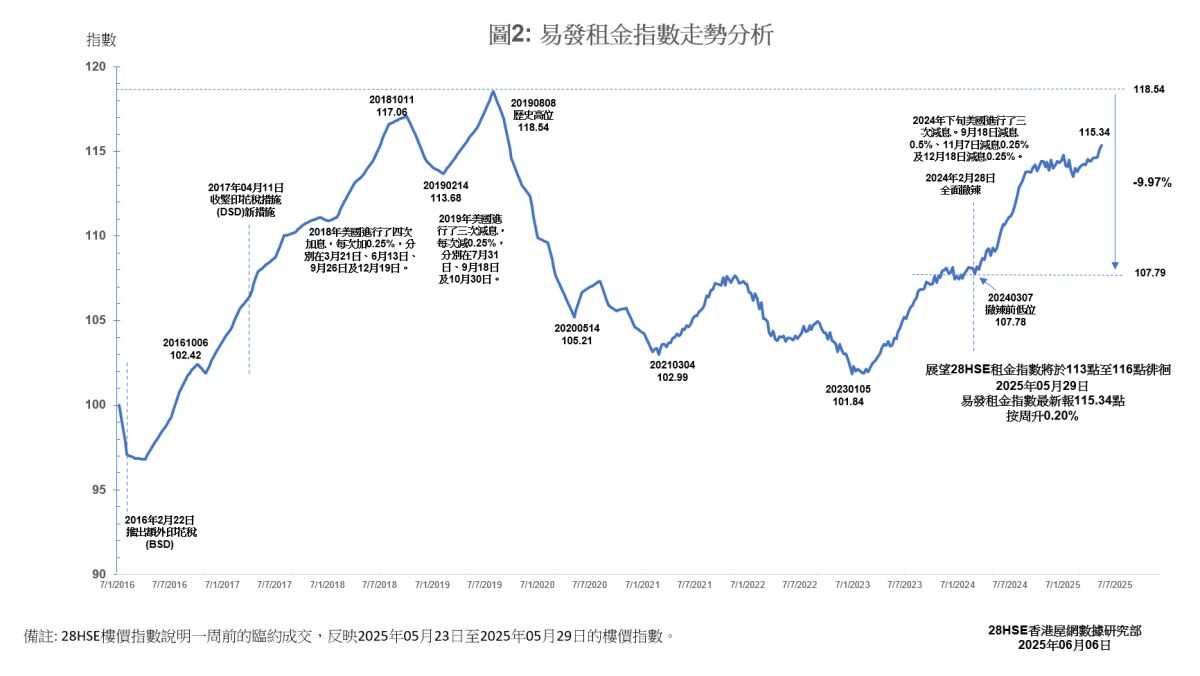

The Eva Rental Index climbed to 115.34 points, up 0.2% week-on-week, marking six consecutive weeks of increase and reaching a new high for 2025. This reflects strong momentum in the rental market.

Agents attribute the rental increase mainly to the approaching peak rental season, particularly with a surge of mainland Chinese students arriving early to secure rental units, which has significantly boosted demand.

At the regional level, rental trends show a “three up, one down” situation:

New Territories East rebounded to 117.27 points, up 0.37 points week-on-week.

Kowloon and Hong Kong Island both saw slight increases to 115.89 points (+0.12%) and 119.85 points (+0.09%) respectively, indicating stable rental demand in core areas.

New Territories West was the only region to record a decline, dropping to 134.43 points (-1.05%) after hitting a record high last week, suggesting a technical correction following earlier rapid gains.

Overall, the rental market remains demand-driven, although certain regions may undergo short-term adjustments due to previous surges.

This week's index reflects market conditions from May 23 to May 29, 2025.

Like