- Home

- News

- Property Index

- Decline In Hibor And Temporary Pause In Us-china Tariff Dispute Fail To Significantly Boost Hong Kong Property Market; Eva Property Index Slightly Falls By 0.28%

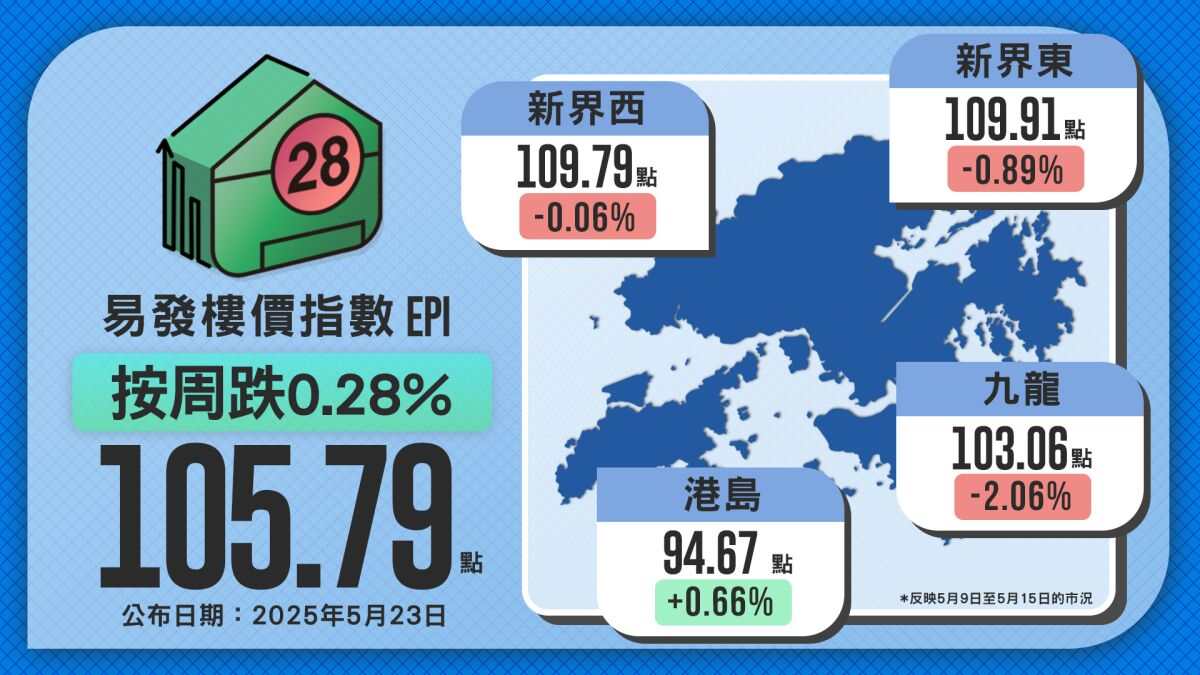

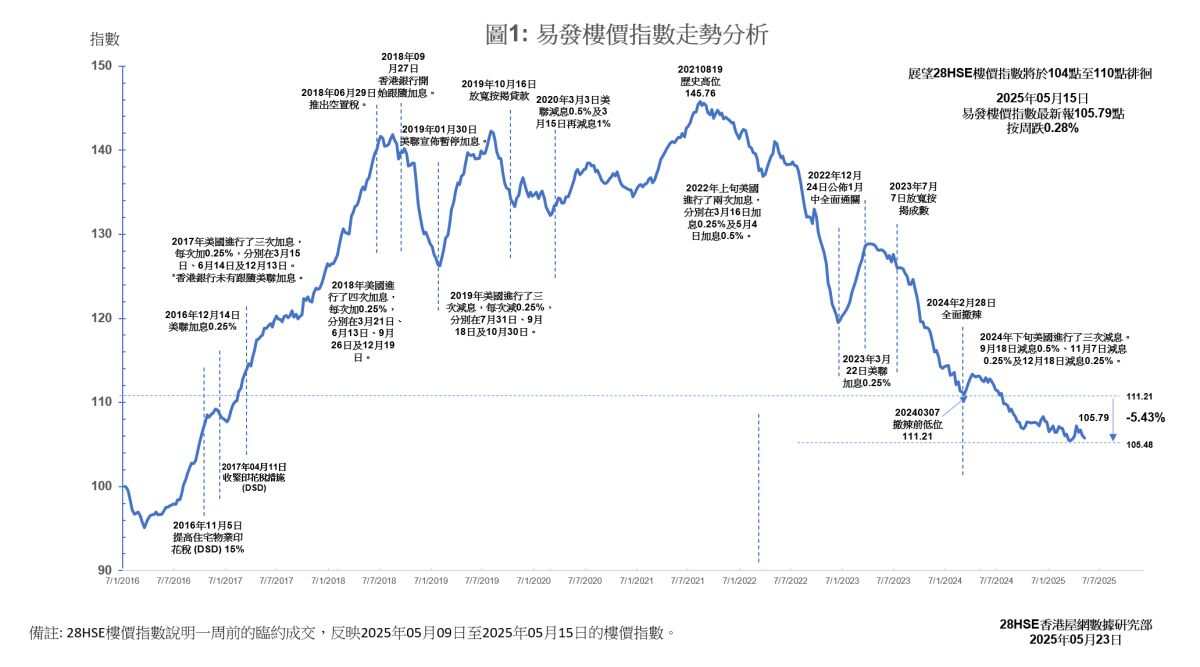

The Hong Kong property market remains in a period of adjustment. Although the Hong Kong Interbank Offered Rate (HIBOR) continues to decline—driven by an increase in the banking system's aggregate balance—resulting in an effective mortgage rate recently dropping to 1.89% (a three-year low), which helps ease mortgage burdens, the market response remains weak. According to the latest Eva Property Index, the figure stands at 105.79, reflecting a slight week-on-week drop of 0.28%. This marks the second consecutive week of decline and keeps the index at its lowest point in eight and a half years. Since the beginning of this year, the index has cumulatively fallen by 1.8%, indicating that even with a low-interest-rate environment, buyer enthusiasm remains subdued. Additionally, data from real estate agents show transactions among the top 50 housing estates fell to only 83 cases, a weekly drop of nearly 10%, highlighting the strong wait-and-see sentiment and a lack of capital inflow into the secondary market.

Regional Performance: Three Zones Down, One Up

Regionally, property price trends remain volatile. Of the four main regions, three saw declines while only one recorded an increase. Kowloon experienced the most significant drop, falling 2.06% week-on-week, with the index at 105.23, reverting to levels seen in late February this year before the government revised stamp duties on properties under HK$4 million. Meanwhile, due to strong interest in the "Sierra Sea" project in Sai Sha, which captured market attention, the property indices in New Territories East and West dropped 0.89% and 0.06% respectively, now standing at 109.91 and 109.79 points.

Despite a temporary 90-day suspension in the US-China tariff dispute, which slightly eased short-term geopolitical risks, it has not significantly boosted the local housing market. Market sentiment remains cautious regarding the global economic outlook. In the absence of strong positive news or policy support, the Eva Property Index is expected to hover between 104 and 108 points during the latter half of the year.

Eva Rental Index Holds Steady at 114 for 11 Consecutive Weeks

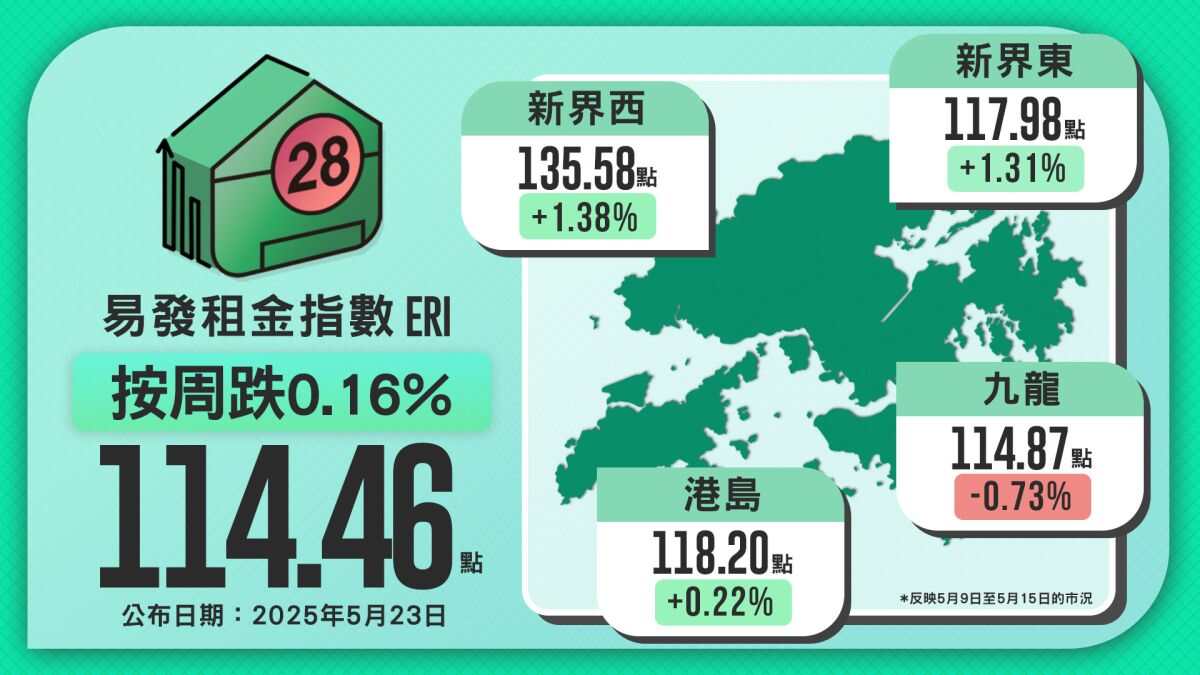

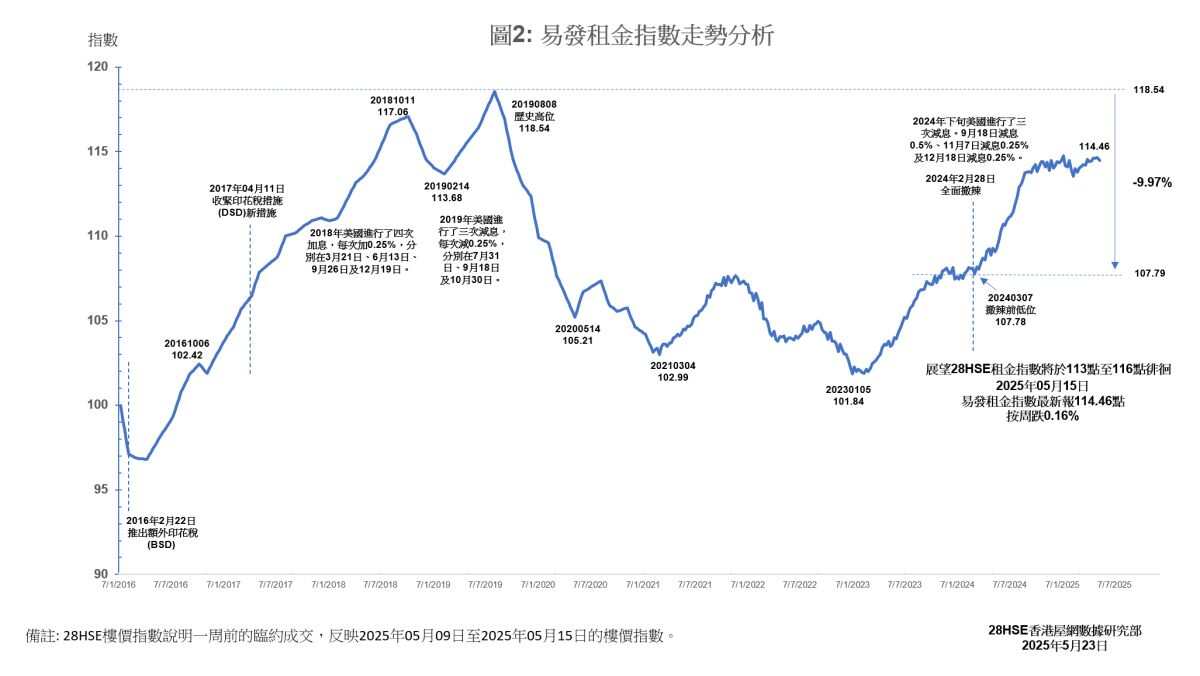

The residential leasing market in Hong Kong continues to demonstrate stability. The latest Eva Rental Index reports 114.46 points, unchanged month-on-month. Even with a slight 0.16% week-on-week dip, the index remains near the high levels seen in early 2019, indicating resilient rental demand. Compared to the continuously declining property price index, which is at its lowest in over eight years, the relatively strong rental index suggests that the rental market is more resistant to downturns than the sales market. This may be linked to a more cautious homebuying sentiment among residents and an increase in short-term rental demand.

Rental Performance by Region: Three Up, One Down

This week, rental indices displayed a "three up, one down" trend. The New Territories West led with a 1.38% weekly rise to 135.58 points, topping all four regions. New Territories East followed with a 1.31-point increase, reaching 117.98, showing more active leasing activity in the New Territories. Hong Kong Island also recorded a slight increase, while Kowloon saw a drop of 0.73 points to 114.87, the only region to decline—possibly due to specific estate adjustments or changes in supply. Overall, while property prices continue to decline, the rental market remains relatively stable, continuing to offer landlords steady returns.

This week's index reflects market conditions from May 09 to May 15, 2025.

Like