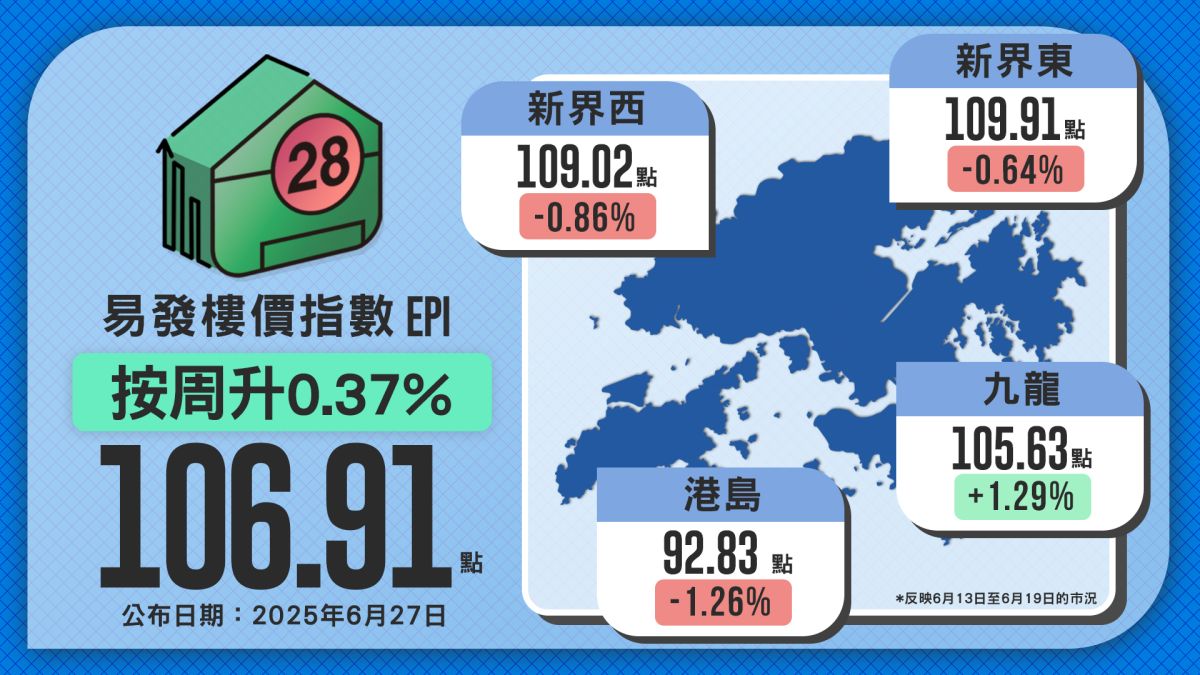

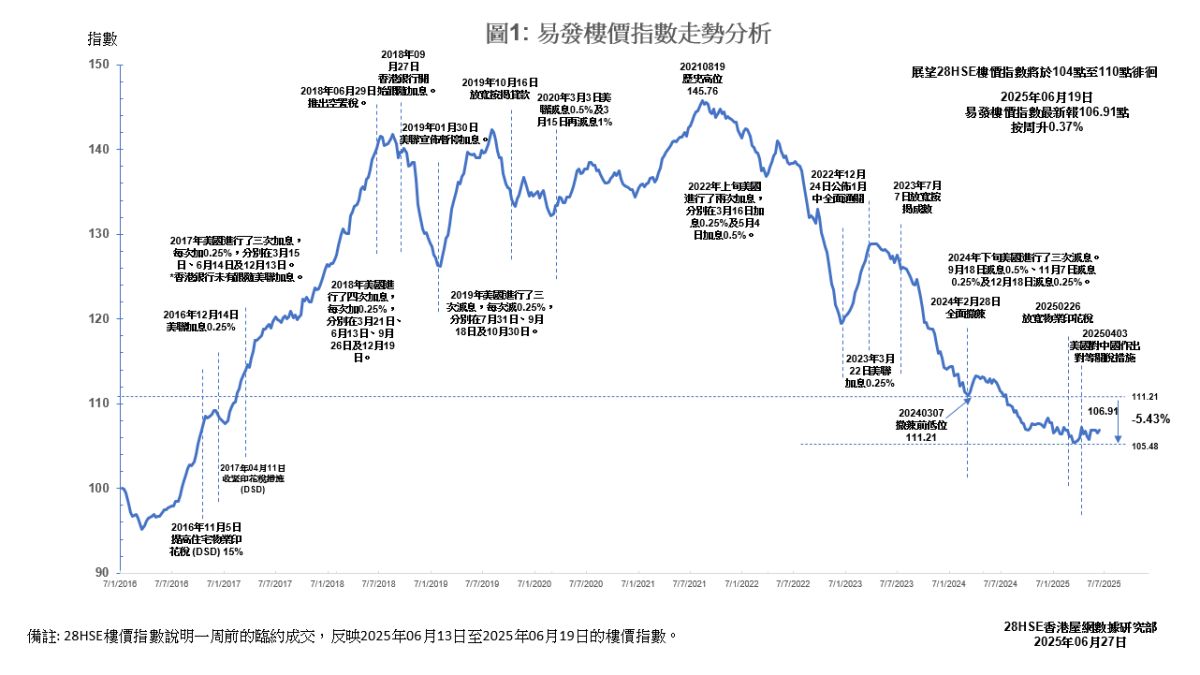

The latest Eva Property Index Home Price Index stands at 106.91, ending a two-week decline with a slight weekly increase of 0.37%. Since April, the index has hovered in a narrow range around 106 points for nine consecutive weeks, indicating that price volatility in the property market has eased and the overall trend is stabilizing.

Although property prices have fallen by a cumulative 0.8% so far this year, the pace of decline has recently narrowed. This improvement is largely supported by the continuous drop in the 1-month HIBOR (Hong Kong Interbank Offered Rate), which has in turn driven down mortgage interest rates, lowering home ownership costs. These factors have injected positive momentum into the market and boosted buyer interest.

Meanwhile, data from the Rating and Valuation Department also showed that the home price index rose for the second consecutive month in May, further confirming signs of price stabilization. Looking ahead, the Eva Property Index is expected to drop no more than 3% for the whole of 2025.

Although estate agency data shows that the number of weekend viewing appointments for second-hand homes fell slightly week-over-week, it remained above 400 for the fifth straight week, reflecting stable market demand and sustained buyer enthusiasm. Among the top 10 indicator estates, over 450 viewing appointments were recorded, down 3.2% week-on-week, but overall market sentiment has clearly improved over the past two months.

As the interest rate environment continues to ease, underlying purchasing power is gradually being released, signaling the early stages of a property market rebound.

Kowloon Region Posts Three Consecutive Weekly Gains, Up 1.29% This Week, Leading Overall Price Index Upward

A breakdown by region shows diverging trends. Kowloon experienced the most notable price increase, with the latest index at 105.63, up 1.29% week-on-week and marking three straight weeks of gains. The rise may be linked to a lack of major new projects launched in Kowloon recently, causing potential first-hand homebuyers to turn to the second-hand market. Combined with a wider bargaining range from sellers, this has increased transaction activity in the area.

In contrast, Hong Kong Island’s price index continues to face pressure, declining for the fourth straight week with a 1.26% weekly drop. Analysts widely attribute this to the newly launched “Austern” atop Wong Chuk Hang Station, which was priced at or slightly below market value, diverting buyer interest away from second-hand homes in the district. All 138 units released in the first batch last Saturday sold out immediately, highlighting strong demand for attractive new projects and creating pressure on nearby second-hand listings.

New Territories See Mild Adjustments as Buyers Await New Launches

In the New Territories, both the East and West districts experienced slight corrections. The latest indices were 109.91 and 109.02, respectively, down 0.64% and 0.86% week-on-week. Market sources report that the “NOVOLAND Phase 3A” project in Tuen Mun may launch before the end of the month, prompting some potential buyers to take a wait-and-see approach and delay their purchases. This contributed to slightly slower transaction activity and marginal price declines in those regions.

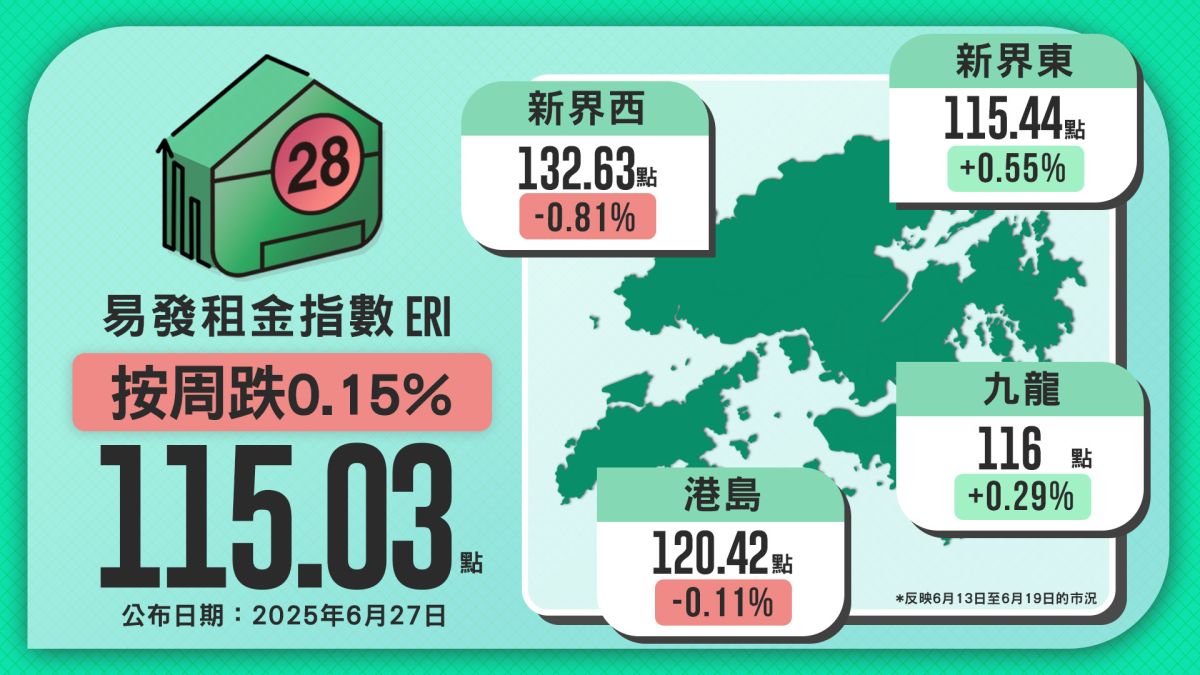

Eva Rental Index Stays Elevated with Mixed Regional Performance

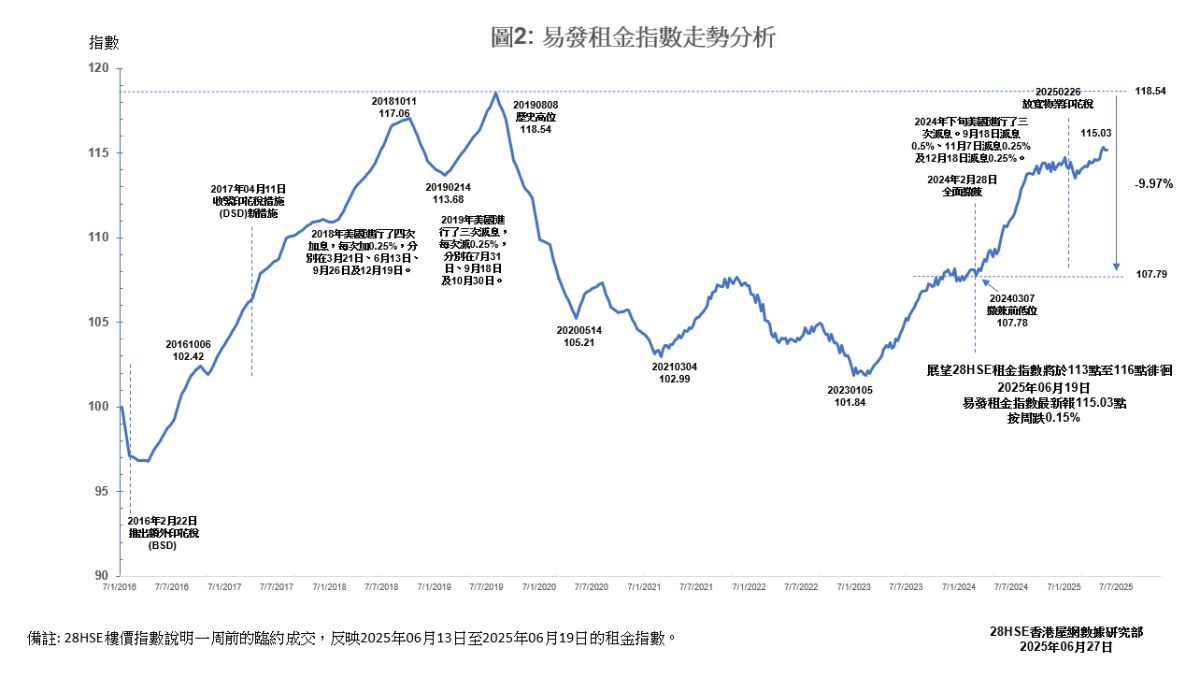

The latest Eva Rental Index came in at 115.03, down slightly by 0.15% week-on-week but still hovering near its high levels seen earlier this year. While the rental market remains generally active, some prospective tenants have postponed decisions due to a lack of desirable listings. Additionally, the ongoing low HIBOR has encouraged some renters to consider buying instead, contributing to a minor drop in rental demand and, consequently, a slight dip in the rental index.

Regionally, the rental market showed a mixed “two up, two down” performance. The New Territories East reversed a three-week decline, rising 0.55% to 115.44. Kowloon also saw a 0.29% increase, reaching 116. Meanwhile, New Territories West extended its four-week losing streak with a 0.81% decline to 132.63, making it the weakest-performing region.

Some agents noted a growing number of discounted listings in areas such as Tsuen Wan, Kwun Tong, and Tung Chung. With wider room for negotiation, some tenants opted to switch from renting to buying, turning rental demand into purchasing power and adding pressure on rental prices.

Summary

Overall, while the rental index is undergoing a short-term correction, it remains relatively high. Market sentiment appears stable, with no clear signs of significant weakening.

Like