- Home

- News

- Property Index

- Price Index Increases By 0.74% Week-on-week: Tariffs And New Developments May Continue To Put Pressure On Property Prices

According to the latest data, the Eva Property Price Index recorded 107.78 points this week, a slight week-on-week increase of 0.74%. However, this rise is mainly attributed to the recent slowdown in the launch of new property developments, which has narrowed the bargaining space in the secondary market. Some homeowners have taken advantage of this brief period of respite to expedite transaction processes and avoid significant price cuts. As the impact of US tariff policies gradually emerges, it is expected to further weaken Hong Kong's economy and contribute to uncertainty in the local real estate market. In the short term, property price trends will depend heavily on the monetary policy direction of the US Federal Reserve and whether the launch of new developments resumes in the coming months.

Although sales activity in the primary market has recently slowed significantly, this lull may not last long. For instance, the Sierra Sea project by Sun Hung Kai Properties in Sai Sha has entered the market at one of the most competitive discounted prices among similar developments in New Territories East over the past decade. This suggests that the upcoming new project launches may adopt a low-price strategy, which will inevitably exert further pressure on secondary market property prices and intensify market competition.

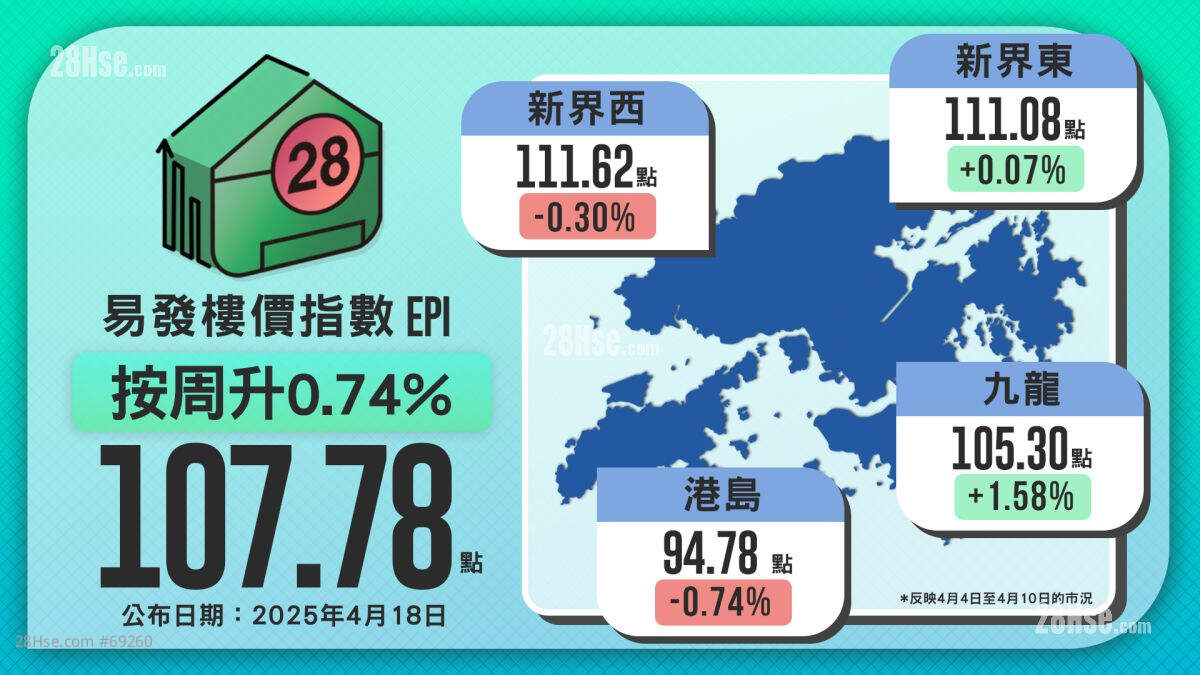

From a regional perspective, the price index this week showed a mix of "two gains and two declines." The Hong Kong Island index fell by 0.74% week-on-week to 94.78 points, marking the largest decline among the four regions. The New Territories West index dropped slightly by 0.3% to 111.62 points. On the other hand, the Kowloon index rose by 1.58% week-on-week to 105.3 points, making it the region with the largest increase. The New Territories East index recorded a marginal rise of 0.07% to 111.08 points. This divergence highlights significant differences in market performance across regions, reflecting the varied supply-demand dynamics and market sentiment in different areas.

Market Outlook: Property Prices Under Short-Term Pressure Amid Multiple Challenges

Overall, Hong Kong's property market continues to face significant challenges due to multiple uncertainties in both external and internal environments. Geopolitical tensions, uncertainties surrounding US interest rate policies, and intensified competition from low-priced new developments all contribute to the pressure on the market. In the short term, property prices are likely to remain under pressure. However, if favourable policies such as interest rate cuts or the relaxation of property market regulations are introduced, market confidence could recover, allowing property prices to gradually stabilise and paving the way for a more steady development phase.

Rental Prices Remain Stable at High Levels, with Demand on the Rise

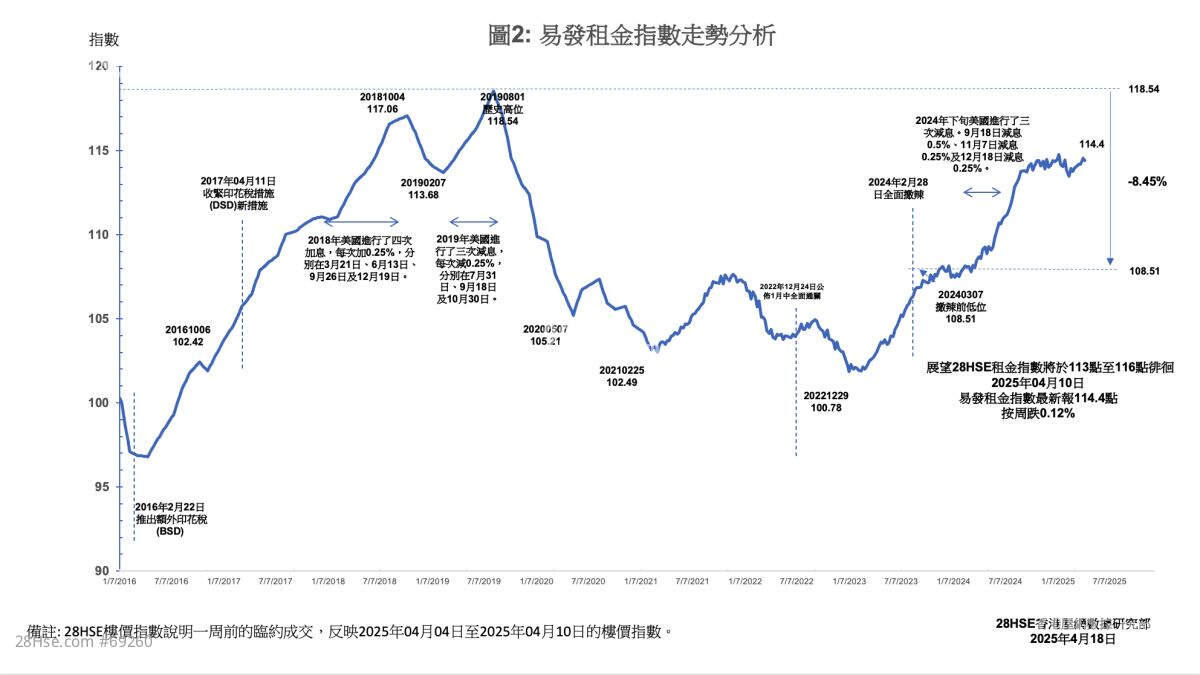

According to the latest data, the Eva Rental Index recorded 114.4 points this week, representing a slight week-on-week decline of 0.12%. Despite this minor adjustment, the overall market remains stable, with rental demand continuing to support prices at high levels and gradually building momentum for further increases.

This week, rental index performance varied across regions. The Hong Kong Island index stood at 117.87 points, down by 0.61% week-on-week, marking the largest decline among the four regions. The Kowloon index recorded 115.76 points, a week-on-week decrease of 0.29%. The New Territories East index stood at 116.27 points, edging down by 0.06%. On the other hand, the New Territories West rental index recorded 131.47 points, up by 0.63% week-on-week, making it the only region to post an increase. The rise in New Territories West reflects strong rental demand in the area, particularly for small- to medium-sized units.

The rental market remains active, with tenant demand consistently high. Supported by buyer demand, rental prices continue to stabilise at high levels and show signs of accumulating upward momentum. Recent stock market volatility has prompted some buyers to shift to the rental market, providing additional support for residential rental prices. Additionally, some tenants have started pre-leasing properties in advance, further driving up rental transaction volumes.

Moreover, the trend of increased immigration to Hong Kong is strengthening. During the summer months, a new wave of rental demand is expected to emerge, particularly from non-local students seeking housing. This will create additional upward pressure on residential rental prices. Market forecasts suggest that overall rental prices could increase by 3% to 5% this year.

While the Eva Rental Index recorded a slight decline this week, the fundamentals of market demand remain robust. Buyer demand, population growth, and the impact of non-local students all continue to support residential rental prices. With the rental market becoming increasingly active, rental prices are expected to maintain steady growth in the coming months, and the market outlook remains positive.

This week's index reflects market conditions from April 04 to April 10, 2025.

Like